Why We Believe in Hedging

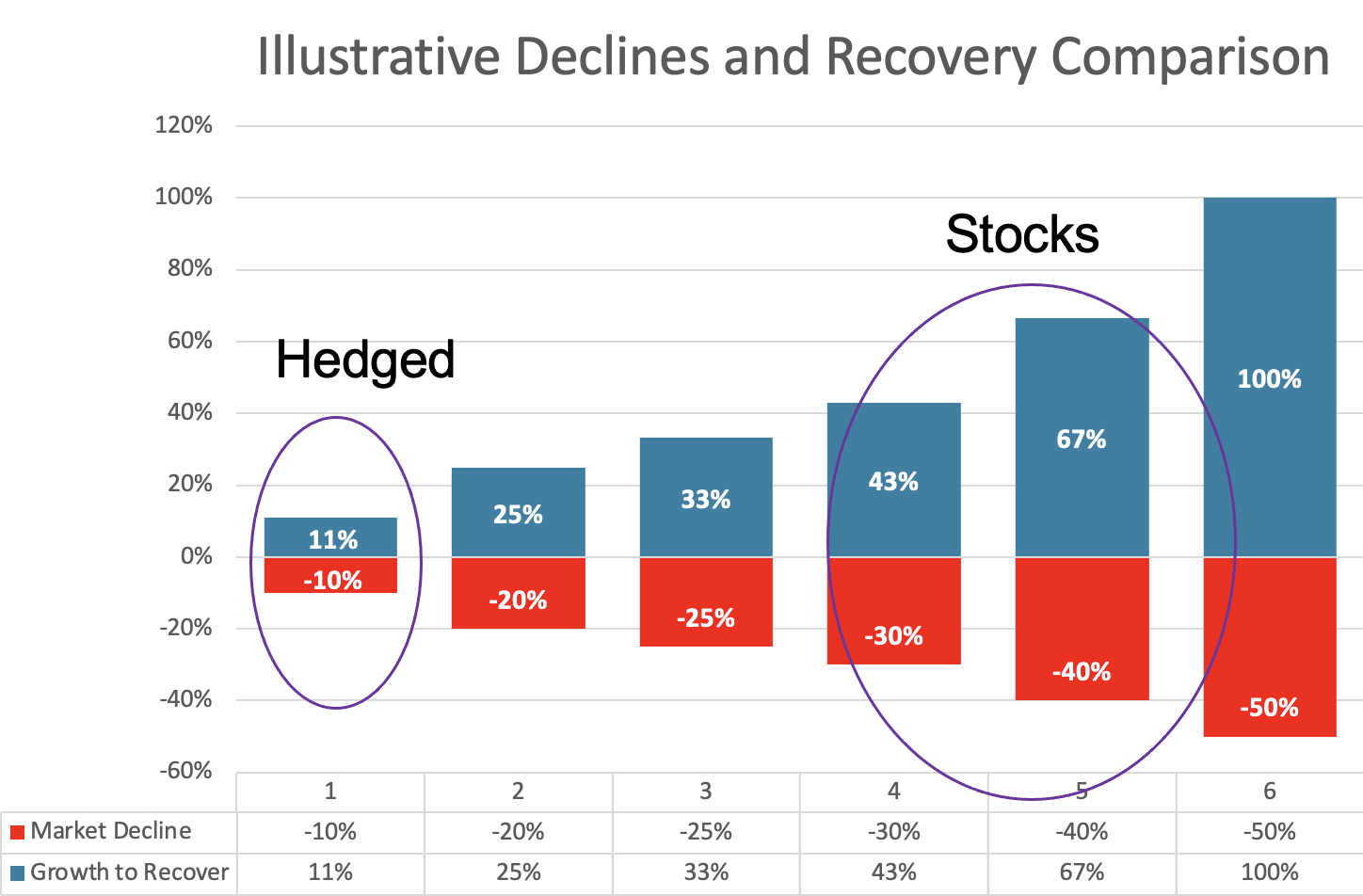

Overcoming smaller losses mathematically makes recovery more achievable and potentially quicker.

(i.e., downside mitigation)

Being “hedged” creates the opportunity to re-invest the losses avoided while the market is discounted.

(i.e., You’ll have the funds available to “buy low.”)

Source: ZEGA Financial. Hedged and Stocks graphs derived from basic math calculations illustrating the need of smaller gains to make back smaller losses.

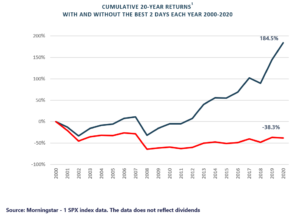

The Hedger’s Opportunity to Buy Markets Lower

Who doesn’t want to buy into the market at lower prices?

If a portfolio is hedged while the market materially drops and you only participated in the first 8% to 10% down, using the avoided loss allows investors to buy in at lower levels. When markets eventually rebound, it potentially could control more shares on the way back up because you were able to put ‘dry powder’ to work. All the while, you could still have hedges in place should another leg down happen.

Losing Less Means Quicker Recoveries

When you lose less, it takes less of a move to make back those losses. Lose 50%, you need 100% in gains to get back to break even. Lose 10%, it only takes an 11% gain to get back to even. A hedged equity strategy that is designed to avoid a significant amount of market downturns means you get to reinvest lower and upon a solid recovery, your recover time may be reduced.

How the Hedgers Opportunity Works at ZEGA Financial

Our hedged equity strategy uses options designed to control but a notional amount generally equal to the account value.

This provides the potential to capture upside moves in the broad S&P 500 Index. Since those instruments are limited to a maximum loss, along with our hedged fixed income, we can define a downside target of no more than 8%-10% down over the course of 12-months. If markets selloff below those levels, we can opportunistically use the avoided loss to reset the portfolio when the S&P 500 is lower in value.

This approach offers investors the ability to still capture a target of around 70% of the upside while holding the hedgers opportunity to re-establish long exposure at lower prices.

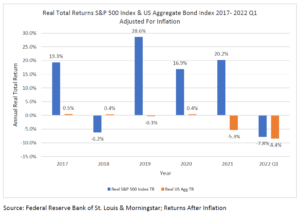

An Attractive Strategy For Retirees (and Investors Who Need Growth, but Cannot Afford 2008-Like Downside)

With many people living longer than ever, money must last longer than ever. Those nearing or in retirement cannot stand to take significant losses. They simply won’t have the accumulation time needed to work back up to prior asset levels. Hedged equity looks to limit losses to a more management amount while allowing for the potential to capture a good portion of upside in markets. Staying in the market is important and waiting in cash or bonds at current interest rates may not provide enough growth.

Hedged equity offers growth while the hedger’s opportunity provides enough optionality to add to this bucket when markets are lower. Stay Invested. Stay Hedged.

Learn more about ZHDG here.

And watch our CEO, Jay Pestrichelli chat with Jill Malandrino on Nasdaq’s Trade Talks here.