Past performance is not guarantee of future results. Index performance does not reflect fees. Once cannot invest directly in an index.

Past performance is not guarantee of future results. Index performance does not reflect fees. Once cannot invest directly in an index.

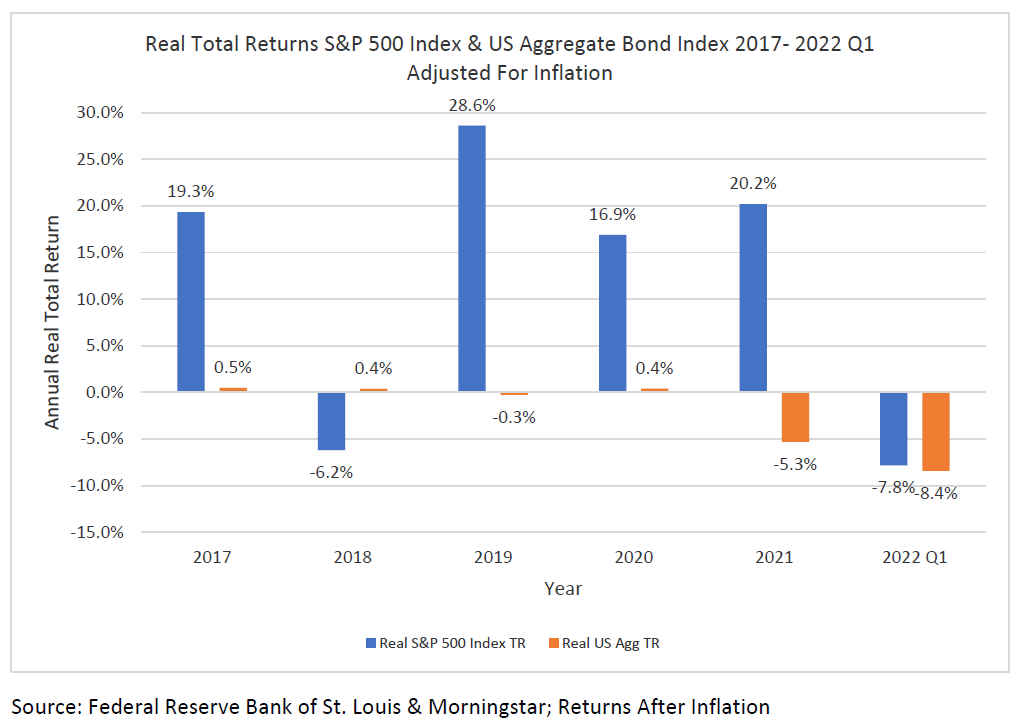

Bonds Not Keeping Pace with Inflation

Even before this period of higher inflation, bond real returns (return – inflation) have been paltry.

Since 2021 they have become negative further increasing the loss of purchasing power. Their usefulness in the context as a hedge for equities may have run its course. For your clients, their costs and needed withdrawals in retirement are going up without the needed growth to pay for it.

To outpace inflation, we believe owning equities with defined risk hedges offer better real return opportunities.

Interest Rate Risk on Bonds Higher Now

We know bonds and interest rates are inversely correlated.

With interest rates so low, the sensitivity of bond market values is higher. If rates spike higher, bonds may experience more downside in the past. While many advisors have never been through a period of higher inflation, they may be tempted to refer to prior historical periods like the late 70’s.

Unlike then, today interest payments (coupons) are significantly lower will not offset market value losses due to spikes in rates.

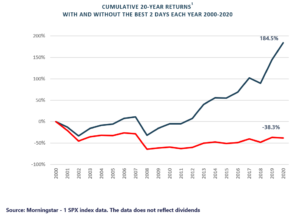

We Believe Hedging is a Better Way to Manage Risk

The drag on portfolio returns from bonds has only increased of late.

Yet the potential gains in a selloff are blunted by how much lower rates can go to or through the lower zero bound. If drawdowns coincide with spikes in rates, bonds may selloff along with equities. Instead, by using options to create a defined floor in equities, you can aim to capture more growth without interest rate risk.

Why not own more of what you want (equities) while still hedging the downside?

Click here to see how ZEGA’s Buy and Hedge alternative to the traditional 60/40 portfolio

Definitions:

S&P 500 index – Standard & Poor’s 500 Index, is a market-value-weighted index of 500 leading publicly traded companies in the U.S.

US Aggregate Bond Index – Measures the performance of publicly issued U.S. dollar denominated investment-grade debt.

Investors should consider the investment objectives, risks, charges and expenses carefully before investing. For a prospectus or summary prospectus with this and other information about the Fund, click here. For the Fund’s Top 10 Holdings, please click here. Read the prospectus or summary prospectus carefully before investing.

FUND RISKS:

Equity Market Risk. The equity securities underlying the Fund’s option investments may experience sudden, unpredictable drops in value or long periods of decline in value.

Derivatives Risk. The Fund invests in options, which are a form of derivative investment. Derivatives have risks, including the imperfect correlation between the value of such instruments and the underlying assets or index; the loss of principal, including the potential loss of amounts greater than the initial amount invested in the derivative instrument; and illiquidity of the derivative investments. The derivatives used by the Fund may give rise to a form of leverage. Leverage magnifies the potential for gain and the risk of loss.

As with all ETFs, Shares may be bought and sold in the secondary market at market prices. Although it is expected that the market price of Shares will approximate the Fund’s NAV, there may be times when the market price of Shares is more than the NAV intra-day (premium) or less than the NAV intra-day (discount) due to supply and demand of Shares or during periods of market volatility.

The Fund may invest in fixed income securities directly or through ETFs or other investment companies. Fixed income securities are subject to interest rate risk (discussed further herein), call risk, prepayment and extension risk, credit risk (discussed further herein), and liquidity risk. Interest rates may go up resulting in a decrease in the value of the fixed income securities held by the Fund. Credit risk is the risk that an issuer will not make timely payments of principal and interest. Because the Fund is “non-diversified,” it may invest a greater percentage of its assets in the securities of a single issuer or a smaller number of issuers than if it was a diversified fund. As a result, a decline in the value of an investment in a single issuer or a smaller number of issuers could cause the Fund’s overall value to decline to a greater degree than if the Fund held a more diversified portfolio.

References to other securities is not an offer to buy or sell.

New Fund Risk. The Fund is a recently organized management investment company with no operating history.

The fund is distributed by Foreside Fund Services, LLC.

Launch & Structure Partner: Tidal ETF Services